- Expert advice/

- Relationship advice/

- Newlywed couples/

- How to Buy Renters Insurance

- Newlywed couples

How to Buy Renters Insurance

You can get renters insurance entirely without speaking to anyone else: Some insurers automate the whole process through an app or website.

Last updated February 5, 2024

Sponsored Content. We may earn compensation if you click the links or buttons below.

You can get renters insurance entirely without speaking to anyone else: Some insurers automate the whole process through an app or website.

There are a lot of reasons to get renters insurance. It provides you with financial protection in case your belongings are destroyed or stolen, or when a guest gets injured in your home and you’re liable for his or her medical bills. Renters insurance is cheap but it can save you thousands of dollars in the event of a catastrophe it covers.

Not only is renters insurance affordable for almost any budget, it’s also very easy and convenient to get. Unlike other forms of insurance, such as life insurance or disability insurance, you’ll almost always eligible to get coverage regardless of your personal characteristics. You can also get renters insurance entirely without speaking to anyone else: Some insurers automate the whole process through an app or website.

Figure out how much stuff you own

Buying renters insurance starts with making an inventory of your stuff. The value of all your belongings is the amount you’ll want to replace if something like a fire destroys everything, and you’ll want to make sure your policy reflects that amount in its coverage. If you have $20,000 worth of stuff – that TV, that MacBook, that coin collection, that couch, and so on – you should get a renters insurance policy worth $20,000. Anything less and you risk being unable to replace your things.

You need to create a record of everything you own, preferably with photographs and even video. This can be a heavy lift, but there are free home inventory apps and services that make cataloging your possessions easier. When you file a claim, these records will be used to confirm that you actually owned your things as well as the condition they were in prior to the loss.

Make special note of any difficult-to-replace or expensive items like art, collectibles or jewelry. You may want to have the special items you own appraised by a professional. Why note these items? Many policies, if they cover these things at all, only cover items like jewelry or electronics up to a certain dollar amount that may not match up to what they're actually worth. Because of this you may want to buy additional coverage in the form of a renters insurance rider.

For the rest of your stuff, go online and figure out how much it's worth. That will determine how much coverage you need.

Start shopping and get a quote

Now that you know the value of your stuff, it’s time to start shopping. We can help you compare renters insurance policies online and find one that not only meets your coverage needs but also fits easily into your budget. In terms of matching your finances, what you’re aiming for is a low premium, the rate you’ll pay to keep your policy in force. The amount of coverage you need is the largest factor in determining your rate, so the more stuff you need to insure, or the most valuable that stuff is, the higher your premium will be.

Another important factor is your deductible, which is the amount you’ll have to pay out of pocket for claims before the renters insurance company picks up the rest. Common deductibles are $500 or $1,000, and a lower deductible means higher premiums.

Figure out how much you want to purchase in personal liability and medical payments to others coverage as well. This can save you a bundle if you have clumsy or litigious friends.

Once you know how much coverage you need and what you can afford, you can get a quote from the renters insurance company. Quotes estimate how much your premiums will be once the carrier calculates exactly what it will cost to insure you. Quotes can be obtained online or through a renters insurance representative.

Questions to ask your renters insurance representative

Your renters insurance policy will contain all the information you need about your coverage. But these policies are full of legalese and, although usually very thorough and clearly written, are kind of a slog to read through. For that reason, you should discuss everything with your renters insurance representative if you have one, and ask questions like,

- What perils are covered? This question refers to how your stuff gets destroyed, not the kinds of stuff that the renters insurance coverage will replace. Although everything from fire to hurricanes to political unrest will be covered, stuff like floods, earthquakes, and bed bugs may not be covered without special a special rider or endorsement.

- Which of my things are covered? Most items are covered, but many are not. Additionally, even some covered items are only covered up a certain limit of liability – “liability”, in this case, meaning the insurance company’s liability to you – and you may not be able to replace high-value items at full cost. Antiques, collectibles, and memorabilia are often not covered, but check with you representative or read over your policy carefully to confirm.

- Do I have an actual cash value (ACV) or replacement cost value (RCV) policy? These types of policies differ in how the carrier reaches a valuation of each item. Replacement cost coverage means you get value of the item back as new, but actual cash value coverage deducts depreciation from the value. Naturally, the latter is cheaper, but the former may be more cost-effective.

- Will my renters insurance policy cover my partner, roommate, or guest? Although renters insurance policies typically cover any immediate family members, people who live with you, including your partner if you’re unmarried, are not always covered. Ask your representative about adding people who live with you to your policy or if your policy already covers them.

- Will my policy cover me away from home? Generally, the answer is yes, and even extends to your other family members. Your children are covered under your policy while at college, for example, although you should ask your representative if there any limits to that coverage.

Save on your renters insurance premiums

There are a few things you can do to get lower premiums. One way is to buy renters insurance as part of a larger package, like with auto insurance, which is called bundling and could save you money on both policies. Insurers may also give a discount if you agree to stay a customer for a certain number of years. Here are some more ways to lower your renters insurance premium.

- Installing approved security devices, smoke alarms and carbon monoxide detectors can lead to a discount.

- You can take on more risk. If you agree to a higher deductible, you'll pay a lower premium. Just make sure you have enough saved up to cover your deductible if there's an emergency.

- Improve your credit. Having bad credit or a low credit score may raise your premiums. Pay off your debts, which should raise your score and possibly lower your premiums.

- Certain dog breeds could lead to higher premiums and may lead insurers to refuse to sell you a policy outright. Insurers commonly reject pit bulls, Doberman pinschers, Rottweilers and German shepherds; essentially any dog that might injure a guest and trigger a payout from your medical payments to others coverage. Let your insurer know about your dog when shopping to get an accurate quote. Some might be more flexible if you send your dog to obedience school.

You may be charged higher premiums as if you have a recent history of making a lot of renters insurance claims. Smoking will count against you, too.

This article originally appeared on Policygenius.

Policygenius makes it easy to compare and buy insurance. Since 2014, they have helped over 4.5 million people shop for insurance, and protected customers with over $20 billion in coverage. The team is driven by one simple mission: “To get people the insurance coverage they need and make them feel good about it."

Get StartedUp next for you

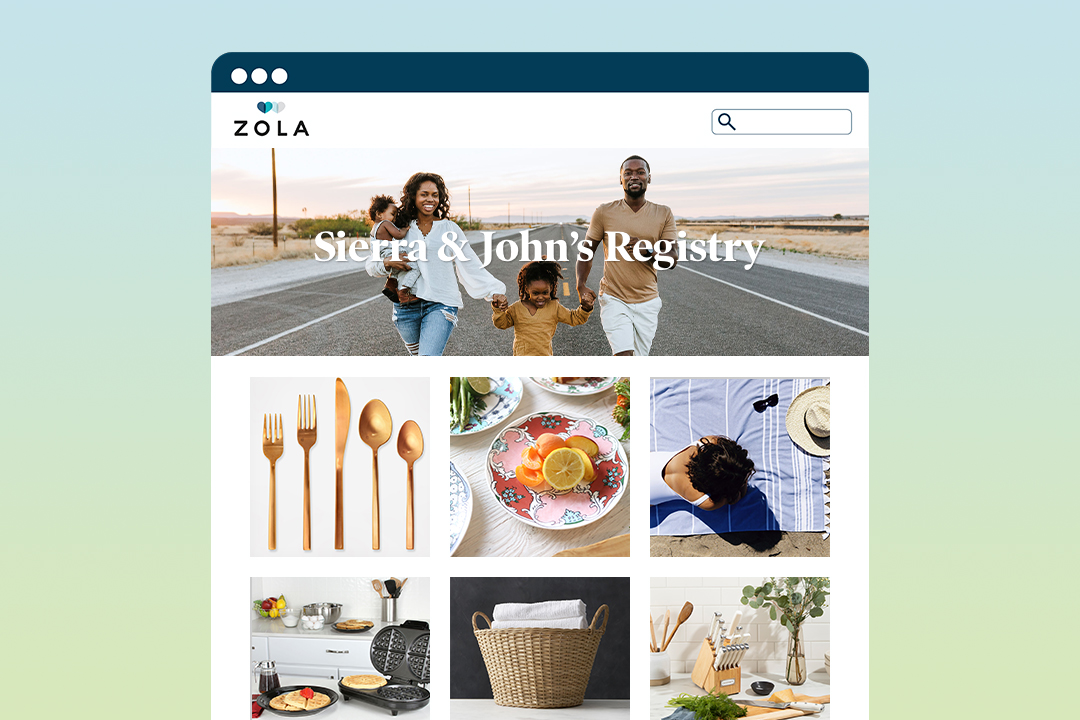

How to Create a Registry if You Already Live Together

How-To

We're here to tell you why building a wedding registry is still really necessary, regardless of whether you live together before marriage.

Your Guide to The Different Types of Homeowners Insurance

Inspiration

Homeowners insurance is for your house, apartment, condo, mobile home, and more. Here's everything you need to know.

Who Needs Renters Insurance?

Inspiration

If you pay rent, you need renters insurance. If you have a property, you can't afford to replace, you need renters insurance.

How to Buy Homeowners Insurance

Insurance

Whether you’re shopping for homeowners insurance for the first time or swapping out one policy for another, you want coverage that suits your needs and doesn’t break the bank.

Featured

10 Things You Should Do as a Newlywed

List

From financial planning and taxes to insurance and legal documents, follow this 10-step list to help you get your newlywed life up and running smoothly in no time.

Engagement Photo Book: Tips + 10 Ideas

Inspiration

An engagement photo book is a beautiful way to put part of your love story on display. Here are the best ways to go about creating it and what you can use it for.

A Guide to Wedding Rings

Inspiration

From how much you should expect to spend on a wedding ring to tips for how to choose the right one for you, check out this guide on wedding ring styles, types, and materials.

12 Fabulous Date Ideas to Put on Your Registry

List

Today’s couples are craving experiences instead of gifts. Our date ideas are fabulous to add to your wedding registry to make memories with your love.

- Expert advice/

- Relationship advice/

- Newlywed couples/

- How to Buy Renters Insurance

Find even more wedding ideas, inspo, tips, and tricks

We’ve got wedding planning advice on everything from save the dates to wedding cakes.